In the first quarter of 2017, United States seniors had an estimated $6.3 trillion locked up in home equity.

That's trillion with a "t."

For a growing number of Americans in their golden years, tapping some of that real estate equity may be the difference in a care-free retirement and a cash-flow crunch.

And for those seniors who find themselves house-rich and cash-poor, these reverse mortgages - what the government calls Home Equity Conversion Mortgages (or HECMs) - can be a godsend, creating liquidity that can reward years of dutiful mortgage payments.

The borrower owes nothing on the loan until the house is sold, generally once the last surviving homeowner permanently moves out of the house or dies.

The Federal Housing Administration, which insures the loans, has three stipulations for reverse mortgages:

* The loan is based on the age of the youngest borrower.

* Homeowners are required to get consumer counseling and education before a reverse mortgage is approved.

* Borrowers must live on the property as a primary resident.

Experts say the reverse mortgage industry remains tiny compared to conventional "forward" mortgages. In Chattanooga, less than 3 percent of those eligible - generally seniors 62 years old or older with at least 50 percent equity in their primary residence - have taken advantage of a reverse montages, according to Nathan Guerrero, of Mortgage South.

Mortgage South, an independent lender with offices on East Brainerd Road, is a local leader in reverse mortgage origination, churning out about 50 reverse mortgage contracts a year - and more than 1,000 since the product became legally viable in Tennessee in the 1990s - Guerrero says.

Reverse mortgages are highly regulated by the federal government but have not caught on with commercial banks, Guerrero says, leaving independent mortgage companies to market and service the products. Increasingly, though, financial advisers are embracing reverse mortgages in some cases to help their clients generate cash flow.

"Our typical customer has Social Security, a small pension and some money put back for retirement," Guerrero says. "Typically, this (reverse mortgage) is something they've thought about for a long time. Maybe their nest egg is not where it needs to be, or they may have (home) maintenance needs."

Modern reverse mortgages are flexible products that can create an income stream for the life of the occupant. For example, Guerrero says a 74-year-old homeowner with a house appraised at $180,000 could qualify for $659 a month for life.

Only a portion of home equity can be tapped for income, he explains. The amount available depends on the homeowner's age, the appraised value of the home, prevailing interest rates and lending limits set by the government.

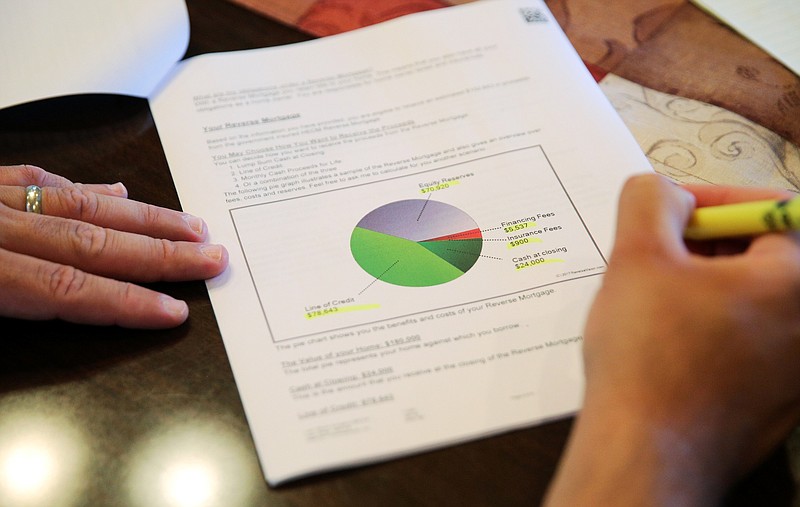

Often, Guerrero says, reverse mortgage customers create a package including a lump sum payout and a line of credit (which accrues interest) that can be tapped at any point in the future. Using the example above, the customer could receive $24,000 cash at closing plus create a $78,643 line of credit. Using a government-mandated formula, $70,920 must be set aside as an "equity reserve," financing fees would add up to $5,537 and insurance $900.

The only out-of-pocket fees in this hypothetical transaction are $350 for a home appraisal and $150 for third-party counseling, a process by which reverse mortgage applicants spend time with a neutral consumer credit expert to vet the transaction before closing the deal.

Most of the third-party counseling is done locally by Consumer Credit Counseling, a nonprofit agency with employees trained to advise potential reverse mortgage customers. Only a small handful of credit counselors in Tennessee are trained on reverse mortgages and two are here in Chattanooga, according to Latricia Schobert, director of the local Consumer Credit Counseling office.

Schobert says that counselors try to stay neutral about the proposed transaction, while educating consumers on the mechanics of the loans. Many of the counseling sessions are conducted over the phone, she said.

"We can't tell someone to get one (a reverse mortgage) or to not get one," she said, noting that the local office does about 20 such counseling sessions a month. "For some people it's a great option. For some, it's not what they should be looking at."

Schobert said the number of reverse mortgages issued has actually declined over time as government oversight on the process has tightened. She said part of the process is explaining amortization to loan applicants and doing a budget review to consider their cash-flow options.