When it comes to Americans and their savings, the numbers tend to be unfavorable.

One-third of Americans are only breaking even every month, according to personal finance website NerdWallet.

GoBankingRates reports that nearly 70 percent of Americans have less than $1,000 in their savings accounts, and 34 percent say they have no savings at all.

A Federal Reserve Board survey found 47 percent of respondents said they would not be able to come up with $400 in the case of an emergency, or they would have to borrow money to pay for unexpected expenses.

LaTricia Schobert, executive director of Consumer Credit Counseling Service in Chattanooga, often sees clients who are struggling to pay their bills, let alone save for future expenses and emergencies. But after working with clients and getting them out of "crisis mode," Schobert says she refers them to one of the many free savings and investing phone apps that have surfaced in recent years.

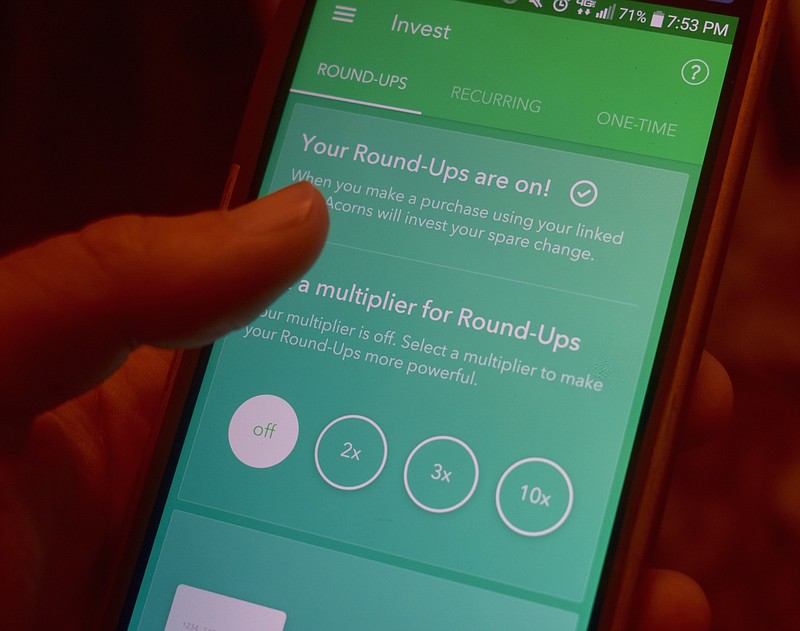

As she puts it, the apps make saving as "mindless" as spending. Schobert said she often recommends Acorns, which is an investing app that links to your debit or credit card and "rounds up" purchases to the nearest dollar, putting that extra change into an investment portfolio. The app is free to download and users can withdraw their money at any time.

"It's savings without thinking about it," she says. "That's the easiest savings and the savings that builds."

Schobert said she also recommends apps, such as Mint, NerdWallet, WalletHub, EveryDollar and others that provide free credit scores, savings accounts and budgeting plans.

"With younger folks, everyone is so attached to their phones, and everybody is just going to use more and more apps," she says. "I think we are going to see more of these pop up in the near future."

With so many free apps available now, it begs the question how brick-and-mortar financial institutions are keeping up. Colin Barrett, president and CEO of the Tennessee Bankers Association, said most of the attention goes to these third-party savings and investing apps when in reality, most banks have "robust" apps now that offer pretty much the same services.

For bank customers with accounts already open, most of the time the bank's app is free to download and use. About 87 percent of U.S. adults have a mobile phone and 43 percent of those have a bank account tied to it, according to figures provided by the Tennessee Bankers Association.

"When it comes to third-party apps, we have seen more budgeting tools," Barrett says. "They are a great supplement to what banks offer, and I don't think one necessarily rules out the other."

Of the 43 percent with a bank account tied to their phone, about 9 percent take advantage of the budgeting tools that banks offer, Barrett says, which he thinks is a "pretty good number" and consists mostly of younger users and millennials.

Several banks offer savings tips and programs to help people track their spending habits. But Barrett and Schobert said Bank of America is the only one that offers "round ups" on purchases, like Acorns.

While rounding up can help with short-term savings, like saving for a plane ticket or vacation, Barrett says he's not quite sure it will help significantly change a person's financial situation.

"I still think having a good savings policy and savings account is going to add up a whole lot quicker than rounding up," he says.

Since almost everyone these days has a smart phone, mobile banking has also allowed banks to reach underserved and "underbanked" populations, like those who are low income and have historically relied on short-term lending agencies where fees can be exorbitant.

Barrett said banks invest millions of dollars in technology to keep up with the third-party apps that are entering the market because it is almost being "demanded" by the younger generations.

"It's more of a long game than a short game," Barrett says. "How profitable is it? It builds strong relationships with financial institutions and creates loyalty."